salt tax cap married filing jointly

Additional standard deduction for the aged or the blind. The additional amount is increased if the individual is also unmarried and not a surviving spouse.

State And Local Tax Salt Deduction Salt Deduction Taxedu

For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT medical expenses.

. It is 5000 for married taxpayers filing separately. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Married couples filing jointly.

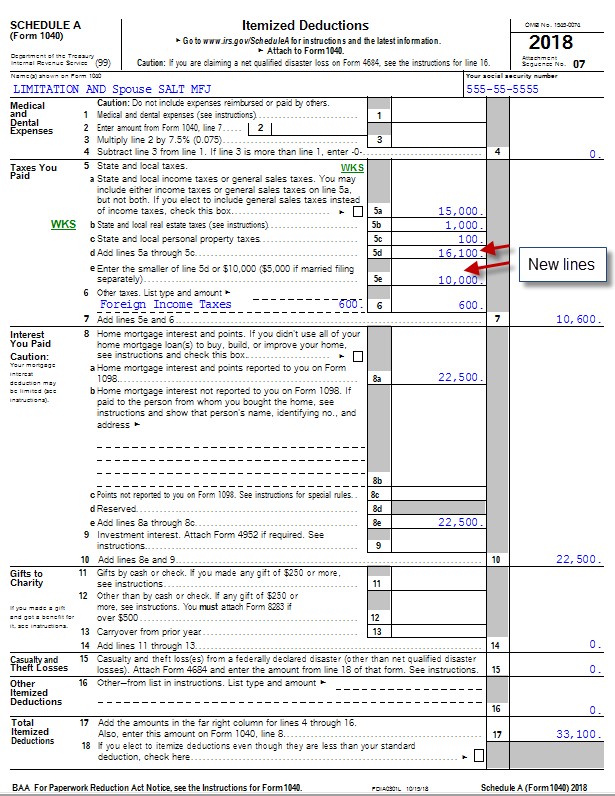

As well as the cap on state and local taxes have had a major impact. Tax reform limits the amount you can deduct from your federal taxes to 10000 5000 if youre married filing separately for all state and local taxes combined. SALT taxes include state and local property taxes and either state and.

Married Filing Jointly 24000 1300 each spouse 65 or older Head of Household 18000. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status. The new law capped SALT deductions at 10000 5000 married filing separately.

New tax law for 2018. By limiting the SALT deduction available to certain taxpayers the SALT cap decreases the tax savings associated with the deduction relative to prior law thereby increasing federal revenues. 11 rows Two single filers may each take up to 10000 in SALT deductions but jointly filing means.

Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. The SALT workaround is an option for the 2021 tax year. Head of a household.

Under current policy the SALT deduction cap is not adjusted for inflation. Single taxpayers and married couples filing separately 6350. Second it would adjust the cap for inflation each year.

We estimate that the proposal to raise the SALT deduction cap and adjust it to. If you are filing Married Filing Joint your total itemized. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers.

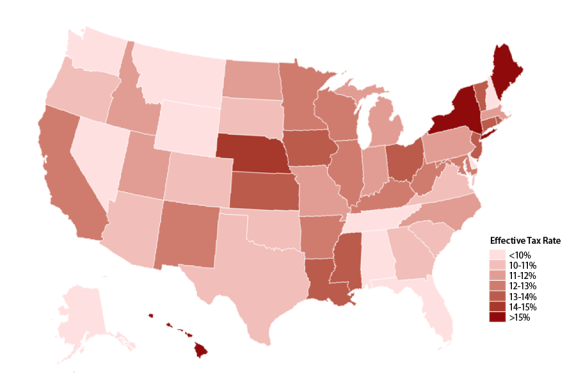

One of these changes particularly crucial to high-tax states was the limit to the state and local income tax SALT deduction. The limit is 5000 if. The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers who are filing jointly in 2019.

When does Californias SALT pass-through workaround start. However the personal exemption of 4050 per person is eliminated offsetting over 23 of the 6000 increase in the standard deduction. As a side note it is a 10000 limit for the combined total of SALT and Real Estate taxes.

Is this the same number for single married filing jointly and married filing singly. 52 rows The deduction has a cap of 5000 if your filing status is married filing. Is it 5000 for Married Filing Separately.

The new cap affected individuals who itemize. The proposal also addresses an unfair marriage penalty where two single filers could each claim a 10000 SALT deduction but once they marry and file jointly theyre still limited to 10000 or. These deductions were unlimited.

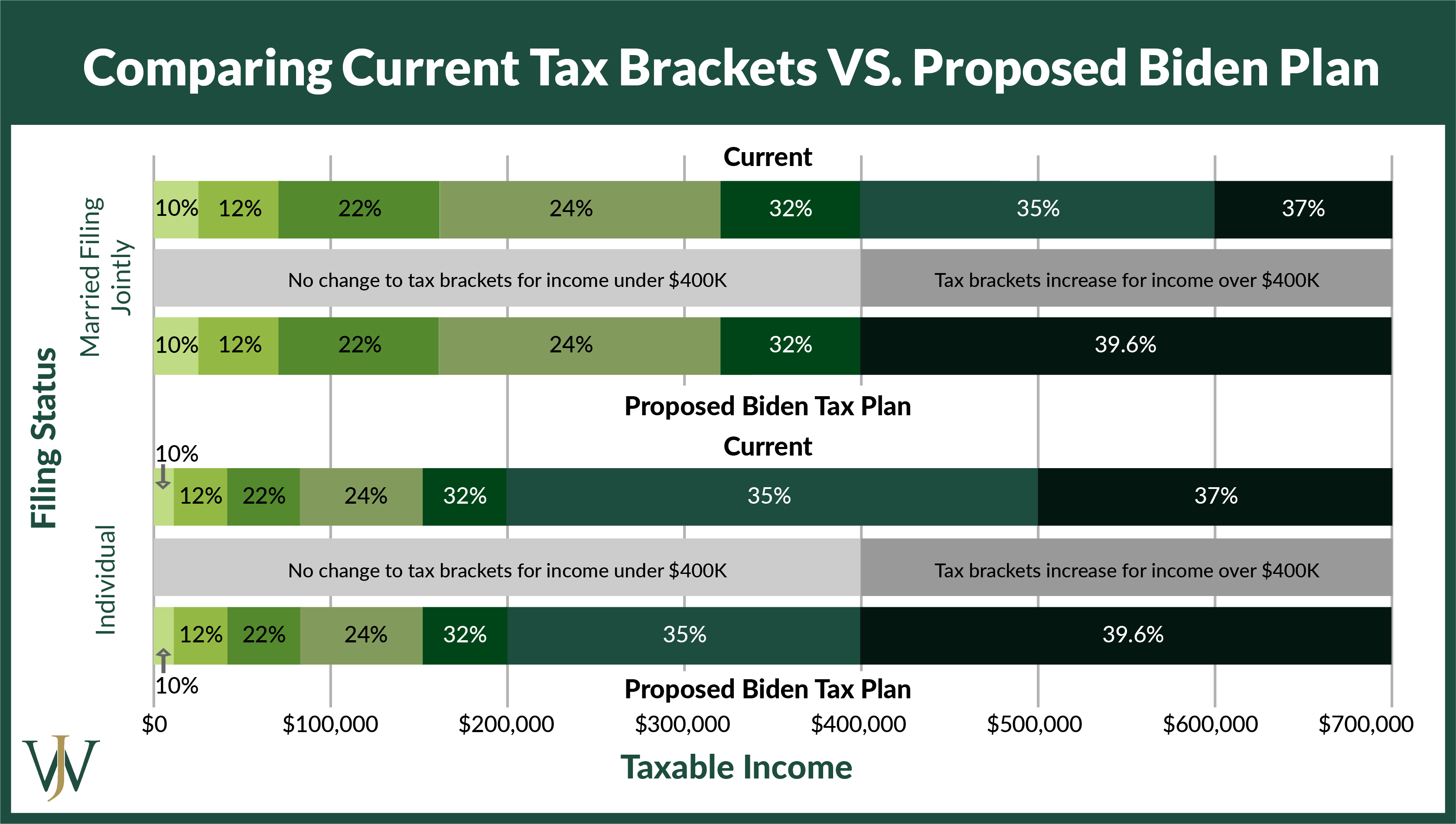

Another proposal is to increase the cap on the SALT deduction to 15000 for individual filers and 30000 for joint filers. The increase to the standard deduction under TCJA resulted in more taxpayers claiming the standard deduction rather than itemizing. For example if you are a person with a Single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions would need to be more than 2550 to exceed your standard deduction amount of 12550 so that you can itemize and deduct SALT.

The 2017 Tax Cuts and Jobs Act limited the SALT deduction to 10000 and married couples filing jointly are harmed by having the same limit to 10000 cap as individuals. Salt cap of 10000. It is available through the 2025 tax year.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and. It is 10000 for all other filing statuses. The Tax Cuts and Jobs Act limited the SALT deduction to 10000 for individuals and MFJ married filing jointly significantly increasing taxpayers effective tax rate.

First it would raise the cap from 10000 10000 for married couples filing jointly to 15000 30000 married couples filing jointly. And there is a max 10000 limit 5000 MFS of property tax and state taxes SALT. The cap takes into consideration income or sales as well as property taxes in aggregate.

In December 2017 the then-GOP controlled Congress capped this longstanding deduction at 10000 for individual taxpayers and married couples filing jointly and 5000 for married people filing. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

What Is The Salt Deduction H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The Salt Cap Overview And Analysis Everycrsreport Com

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

The Salt Cap Overview And Analysis Everycrsreport Com

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Haven T Filed Taxes Recently Here Are Some Deductions That No Longer Exist Gobankingrates